In today's interconnected business landscape, where customer interactions span multiple platforms and data resides in various systems, managing customer information effectively has become paramount. The concept of a golden customer record emerges as a solution to address this challenge. This unified and trusted source of customer data, often referred to as a "single source of truth" or a "single customer view," consolidates vital customer information scattered across different systems within an enterprise. By achieving this data consolidation, businesses aim to enhance sales opportunities, improve customer retention, ensure regulatory compliance and make more informed decisions. In this blog post, we delve into the essence of the golden customer record, its significance, associated challenges and its pivotal role in shaping the future of customer relationship management.

What is a golden customer record?

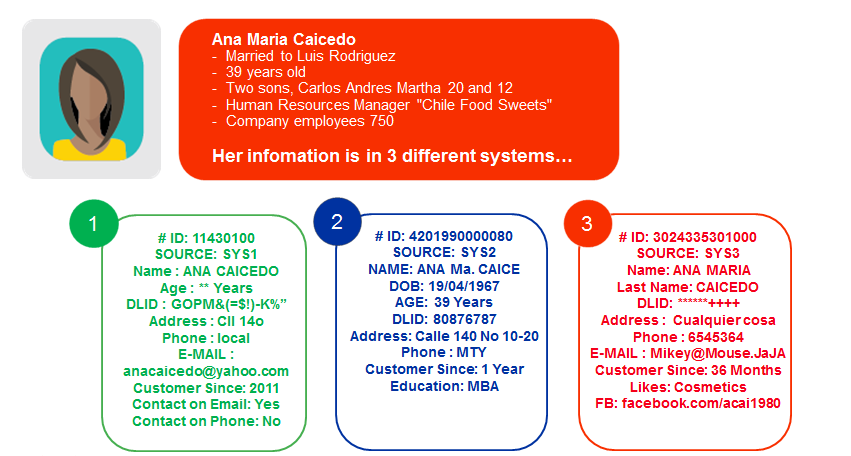

Today, your customers are interacting with you across more platforms than ever with their data being stored across multiple system within your business.

For instance client A, who has life insurance, could be the husband of client B, who has critical health insurance. Disconnected domains store this information as though they were unrelated entities. Another example is if client A purchased car insurance and, separately, medical insurance but because the records are not exact matches, you end up with multiple versions of the customer account. The result is a series of disjointed service, sales and marketing actions that do nothing for your reputation as an insurance provider who puts the customer at the heart of everything they do.

To achieve a truly personal experience; to support regulatory processes; to maximize the sales opportunity of every customer, you need to see these separate records as one. The result of consolidating all accounts of a single customer down to just one record is a golden record.

Golden customer record: Refers to a 'single source of truth' or a 'single customer view' which consists of one unified, trusted version of data that captures all the necessary information we need to know about a customer.

Challenge: Consolidating data from separate, disconnected systems

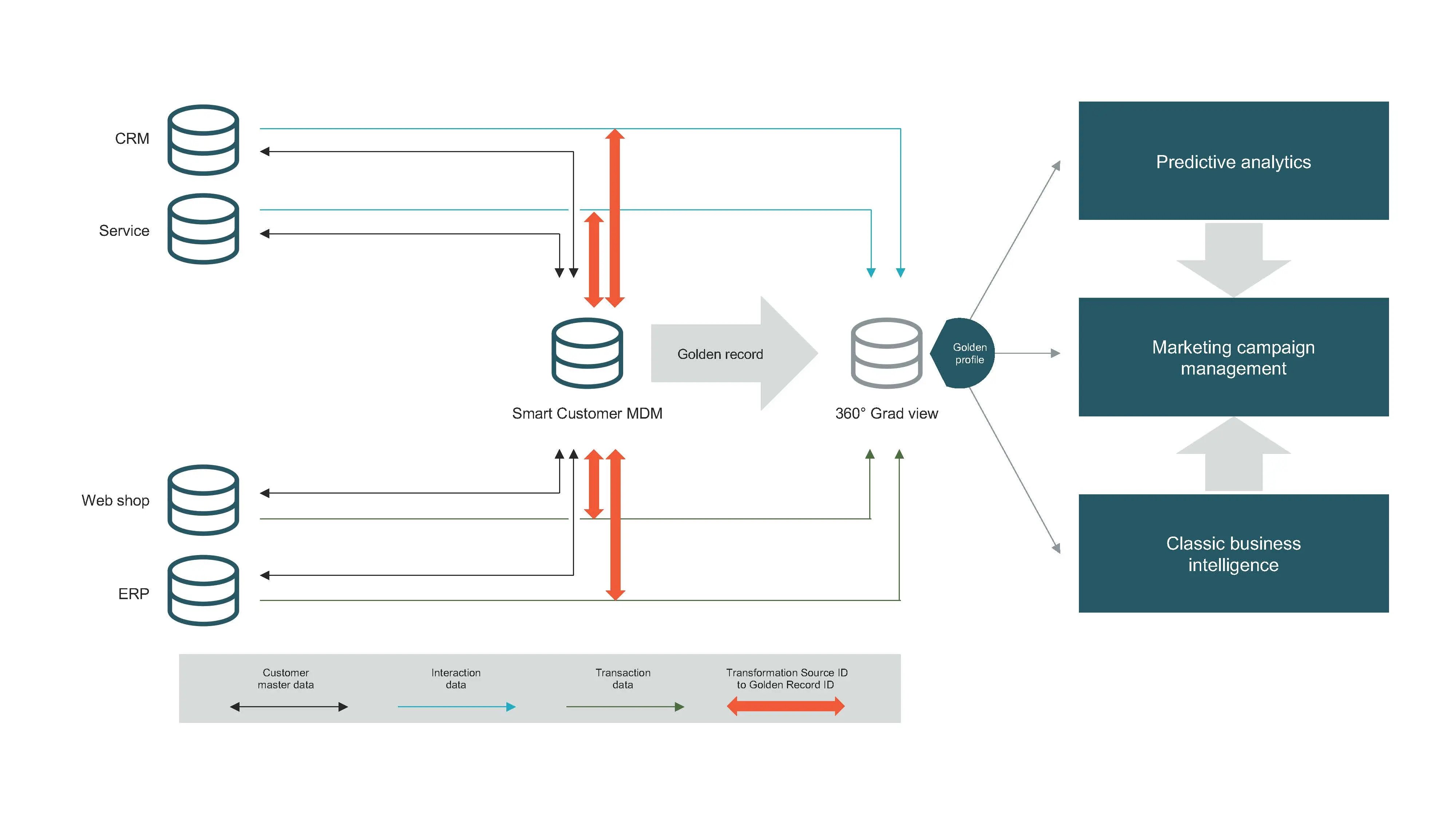

The challenge of consolidating customer and product data comes when it is held in separate locations; ERP, CRM, e-commerce, finance systems, etc.

The quickest and most cost-effective method to achieve this consolidation, without requiring any additional hardware investment, is by inserting a managed data integration layer. It is worth the effort because creating a golden record has many benefits, of which, here are 4 key ones.

4 key benefits of creating a golden customer record

1. Increase sales

Having a single view of the customer allows you to understand more about their needs - it allows you to offer products relevant to their circumstances, increasing opportunities to upsell services and insurance products more attuned to their needs.

It also allows you to build a set of predictable sales processes that define trigger activities based on customer actions. This means you’re never in danger of missing out on sales opportunities because the engagement process to make them happen takes place automatically.

Here’s the upshot: a study by InfoQuest found that a ‘totally satisfied customer’ contributes 2.6 times more revenue than a ‘somewhat satisfied customer’. Furthermore, a ‘totally satisfied customer’ contributes 14 times more revenue than a ‘somewhat dissatisfied customer’.

2. Improve customer retention

By providing insurance products more relevant to each of your customer’s unique needs means they are more likely to feel connected to you, and to trust you.

And when policy holders feel valued by their insurance providers, they are less likely to switch.

An example of putting this into action is using automated systems to send messages to customers who may be affected by adverse weather conditions, for example: customers living in a region expecting regular flooding are automatically emailed insurance policy information and safety tips.

This type of engagement is only possible if you have golden customer records, otherwise the data simply wouldn’t be reliable enough for you to engage on such a personal level.

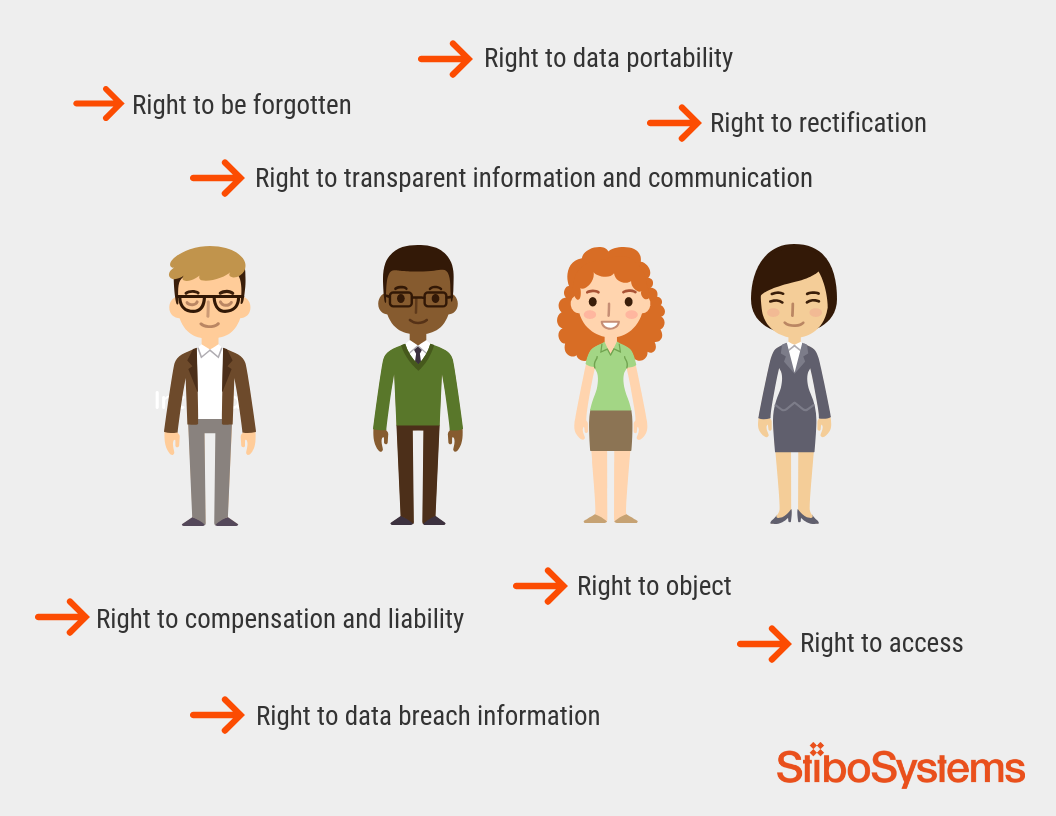

3. Support regulatory control

With the regulatory environment continuously changing as regulations are amended and adopted, you need to have control over your data to ensure compliance.

GDPR, coming in to effect in May 2018 and replacing the Data Protection Directive, is designed to tighten up the control of data management.

Automating information governance policies using data quality management, data enrichment, workflow management, data stewardship and dashboards is essential for monitoring data governance KPIs.

But try doing that with multiple versions of each customer record.

4. Support business decision making

56% of a survey of C-level respondents a Capgemini report stated “organisational silos” are the biggest impediment to effective decision-making.

Imagine then how much of an advantage your business would gain by pulling siloed data together in to a consistent and accurate format and using it to base key business decisions.

You’ll be in a much better position to predict market trends and customer behavior in order to respond quickly.

The ability to manage relationships between golden records to better understand each customer’s total worth and business impact will enable you to direct investments in services and products in the most profitable way.

Common mistakes to avoid when creating and maintaining the golden customer record

When creating and maintaining the golden customer record, businesses can make several mistakes that can undermine the accuracy and usefulness of their customer data. Here are some common mistakes to avoid:

-

Failing to capture all relevant customer data: Businesses may overlook or omit certain types of customer data that are essential for creating a complete and accurate golden customer record. For example, businesses may fail to capture customer preferences, purchase history or contact information.

-

Relying on incomplete or outdated data: Businesses may rely on incomplete or outdated customer data, leading to inaccuracies and inconsistencies in the golden customer record. For example, businesses may fail to update customer contact information or fail to remove duplicate or outdated records.

-

Failing to integrate customer data: Businesses may store customer data in different systems or departments, leading to silos and inconsistencies in the golden customer record. For example, businesses may have separate systems for sales, marketing and customer support, each with their own customer data.

-

Not following data governance best practices: Businesses may not have a clear data governance strategy or may fail to follow best practices for data management leading to issues with data quality and security. For example, businesses may not have clear policies for data privacy and security or may not have procedures in place for data validation and cleansing.

-

Failing to engage customers: Businesses may fail to engage with customers or to gather feedback on their experiences leading to gaps in the golden customer record. For example, businesses may not have mechanisms in place for customer feedback or may not have a clear strategy for engaging with customers.

To avoid these mistakes, businesses should have clear processes and policies for data management and governance, regularly update and validate customer data, integrate customer data from different systems, and engage with customers to gather feedback and improve the golden customer record. By avoiding these mistakes, businesses can create a more accurate and useful golden customer record, leading to better customer engagement, retention, and acquisition.

How to maintain and update the golden customer record

Maintaining and updating the golden customer record can be a challenging task, but it is essential for businesses to ensure that they have accurate and up-to-date information about their customers. Here are some challenges and solutions for maintaining and updating the golden customer record:

Challenges:

-

Data quality: Ensuring that customer data is accurate, complete and up-to-date can be challenging, especially if the data is coming from multiple sources or is being manually entered by employees.

-

Data silos: Customer data may be stored in different departments or systems within a business, making it difficult to create a unified golden customer record.

-

Data privacy and security: Collecting and storing customer data carries legal and ethical responsibilities, and businesses must ensure that customer data is protected from unauthorized access or use.

Solutions:

-

Data validation and cleansing: Implementing validation and cleansing processes can help to ensure that customer data is accurate, complete and up-to-date. This can involve using automated tools to check data quality or manual reviews by employees.

-

Data integration: Integrating customer data from different sources and systems can help to create a more complete and accurate golden customer record. This can involve implementing data warehousing or data integration tools that bring together customer data from different sources.

-

Data governance: Establishing data governance policies and procedures can help to ensure that customer data is managed responsibly and ethically. This can involve appointing a data steward or team to oversee data management practices and ensure compliance with legal and ethical standards.

-

Continuous monitoring and updating: Regularly monitoring and updating customer data can help to ensure that the golden customer record remains accurate and up-to-date. This can involve implementing automated processes for updating customer data or establishing regular review cycles for employees.

Overall, maintaining and updating the golden customer record is an ongoing process that requires a combination of people, processes and technology. By implementing best practices for data validation, integration, governance and continuous monitoring and updating, businesses can ensure that they have a complete and accurate view of their customers, improving their ability to engage, retain and acquire customers.

Key considerations: The relationship between the golden customer record and customer experience

The golden customer record is a crucial tool for businesses to create personalized and seamless customer experiences. Here are some key considerations for the relationship between the golden customer record and customer experience:

-

Personalization: The golden customer record provides a comprehensive view of the customer, including their preferences, purchase history and interactions with the business. This information can be used to personalize interactions with customers such as recommending products or services based on their preferences or previous purchases.

-

Seamless experiences: The golden customer record can help businesses provide seamless experiences across different channels and touchpoints. For example, a customer who contacts customer support should not have to repeat their information as the golden customer record should already have their relevant information.

-

Consistency: The golden customer record can help businesses ensure that customer experiences are consistent across different departments and channels. This can help to build trust with customers and create a consistent brand experience.

-

Data privacy: Collecting and storing customer data carries legal and ethical responsibilities and businesses must ensure that customer data is protected from unauthorized access or use. Customers expect their data to be handled appropriately and businesses must be transparent about their data collection and usage practices.

-

Data quality: To create a useful golden customer record, businesses must ensure that the data is accurate, complete and up-to-date. Inaccurate or incomplete data can lead to incorrect insights or ineffective personalization efforts.

In summary, the golden customer record plays a critical role in providing personalized and seamless customer experiences. To leverage the full potential of the golden customer record, businesses must consider data privacy, data quality and consistency, among other key factors. By doing so, businesses can improve customer engagement, retention and acquisition, leading to a better overall customer experience.

Trends and insights: Using data analytics to optimize the golden customer record

Data analytics is an essential tool for optimizing the golden customer record. Here are some trends and insights related to using data analytics to optimize the golden customer record:

-

Predictive analytics: Predictive analytics is a powerful tool for identifying patterns in customer behavior that can help businesses anticipate future needs and preferences. By analyzing data on customer interactions and purchase history, businesses can create models that predict future customer behavior, allowing them to optimize their marketing and sales strategies accordingly.

-

Customer segmentation: Customer segmentation is a technique used to divide customers into different groups based on their characteristics, behavior and preferences. By segmenting customers, businesses can tailor their marketing and sales strategies to specific groups, improving customer engagement and increasing the likelihood of customer retention.

-

Personalization: Personalization involves tailoring marketing and sales messages to individual customers based on their preferences and behavior. By analyzing customer data, businesses can create personalized messages and offers that are more likely to resonate with customers and lead to increased sales and loyalty.

-

Real-time analytics: Real-time analytics allows businesses to track customer interactions and behavior in real-time, providing insights that can be used to optimize marketing and sales strategies on the fly. Real-time analytics can also be used to identify and respond to potential customer issues or concerns, improving the customer experience and increasing the likelihood of customer retention.

-

Machine learning: Machine learning algorithms can be used to analyze large amounts of customer data and identify patterns and trends that are not immediately apparent. By using machine learning, businesses can create more accurate models for predicting customer behavior and optimizing marketing and sales strategies.

Overall, data analytics is a powerful tool for optimizing the golden customer record. By analyzing customer data and using insights to inform marketing and sales strategies, businesses can improve customer engagement and retention, increase sales and revenue and gain a competitive advantage in the marketplace.

The future of the golden customer record

The golden customer record is a fundamental aspect of modern customer relationship management and its importance is only set to grow in the future. Here are some predictions and emerging trends for the future of the golden customer record:

-

Increased focus on real-time data: As customer interactions continue to become more dynamic and fluid, businesses will increasingly require real-time customer data to create a more personalized and relevant customer experience. This will require investment in real-time data processing and analysis capabilities.

-

Integration with artificial intelligence (AI) and machine learning (ML): The use of AI and ML will continue to grow in the field of customer data analytics, with businesses increasingly relying on these technologies to identify patterns and insights in customer data. The golden customer record will need to integrate with these technologies to enable more sophisticated analysis and personalization.

-

Greater focus on data privacy: The increasing importance of data privacy and the growing regulatory landscape will require businesses to pay greater attention to data governance and security. This will require investment in data protection technologies and policies.

-

More comprehensive data collection: As businesses seek to provide increasingly personalized and tailored experiences, they will need to collect more comprehensive data on their customers. This will require a greater focus on data quality and management as well as investment in data storage and processing capabilities.

-

Integration with Internet of Things (IoT) devices: The rise of IoT devices and smart technologies will provide businesses with new streams of customer data, which can be integrated with the golden customer record to provide a more holistic view of the customer.

In conclusion, the future of the golden customer record is set to be shaped by emerging technologies, data privacy concerns and the growing importance of real-time data. As businesses continue to invest in customer data analytics and personalization, the golden customer record will remain a crucial tool for creating personalized and engaging customer experiences.

The golden record is the golden ticket to success

Customers are the lifeblood of your business, but how connected is your view of who they are, what they buy, where they buy, how they buy and linked dependencies?

Creating a single source of truth, populated with a consolidated golden record view of customer data across the enterprise is vital to properly identify the right information at the right time.