Unlocking the power of master data management: How the right tool can improve your business

Master data management tools are the backbone of any successful business. They help organizations keep track of the most critical information such as customer data, product information and location data. Without a proper master data management tool in place, businesses risk making decisions based on inaccurate or incomplete information, resulting in lost revenue and wasted resources. In this blog post, we will explore the why master data management tools are important to organizations, what are the tools available on the market and the key questions you should be asking when evaluating potential solutions for your organization. From understanding the different types of master data management tools available, to identifying the specific needs of your business, we will cover everything you need to know to make an informed decision. So, whether you are a small startup or a large enterprise, read on to find out how master data management tools can help you stay ahead of the competition.

What is a master data management tool?

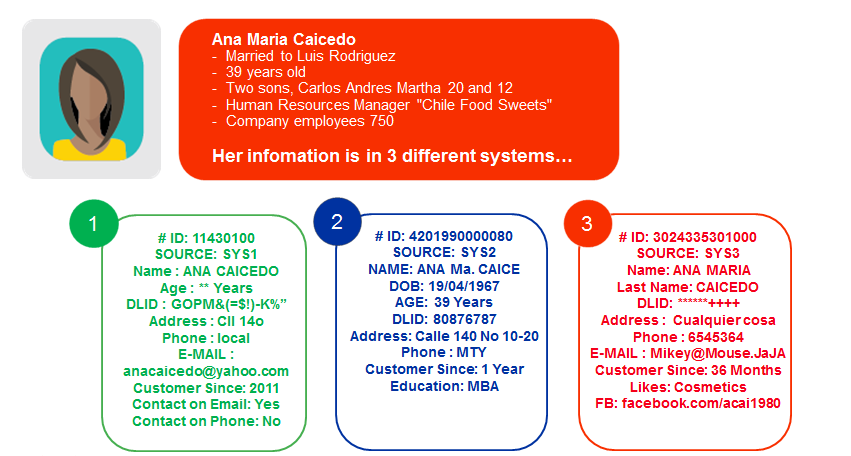

A master data management tool is a software solution that helps organizations manage and maintain consistent and accurate data across multiple systems and applications. It typically includes features such as data profiling, data quality management, data governance and data integration. Master data management tools are designed to help organizations improve data accuracy and consistency, reduce data duplication and errors and ensure compliance with data regulations. Additionally, master data management tools can also improve data sharing and collaboration across the organization leading to better decision-making and improved business processes.

Why do organizations need master data management tools?

Master data management tools are designed to help organizations effectively manage and govern their critical data assets. These tools provide a centralized repository for storing, managing and maintaining consistent, accurate and reliable master data across an organization. They also provide a range of functionalities such as data profiling, data quality, data governance, data modeling, data integration and data security that are essential for ensuring the integrity, completeness and consistency of master data. Organizations need master data management tools to improve data quality, reduce data duplication and errors, increase data security and achieve better data governance. Additionally, master data management tools help organizations comply with regulatory requirements, improve operational efficiency and make better-informed decisions.

What are the different master data management tool available on the market?

There are several different types of master data management tools available on the market. Some of the most popular include:

-

Hub-based master data management tools: These tools provide a central repository for master data and support the management of multiple domains such as customer, product and supplier data.

-

Registry-based master data management tools: These tools provide a central registry for master data and focus on the management of a single domain such as customer data.

-

Data governance tools: These tools focus on the governance of master data and provide functionalities for data stewardship, data quality and data lineage.

-

Data integration tools: These tools focus on the integration of master data across systems and provide functionalities for data mapping, data transformation and data loading.

-

Cloud-based master data management tools: These tools provide master data management functionalities as a service and are accessible from anywhere via the cloud.

-

AI-based master data management tools: These tools use artificial intelligence and machine learning algorithms to improve the quality and management of master data.

Each of these tools has its own strengths and weaknesses and the best choice will depend on an organization's specific needs and requirements.

How do you select which master data management tool is the best fit for your organization?

Selecting the best master data management tool for your organization can be a complex process as it depends on a variety of factors such as the size of your organization, the complexity of your data and your specific business needs. To determine the best master data management tool for your organization, you should first assess your current data management processes and identify any pain points or areas for improvement. This will help you to determine the specific features and functionality that you require from a master data management tool.

Next, it is important to research the different master data management tools available on the market and compare them based on their features, pricing and customer support. It is also a good idea to check out customer reviews and case studies to see how the tool has been implemented and used by other organizations.

Finally, it is important to consider the scalability of the master data management tool and whether it can accommodate the growth of your organization. It is also important to consider the vendor's reputation and the level of support they offer to ensure that you have the resources you need to implement and maintain the tool successfully.

Overall, selecting the best master data management tool for your organization requires a thorough assessment of your data management processes and a careful consideration of the various options available on the market.

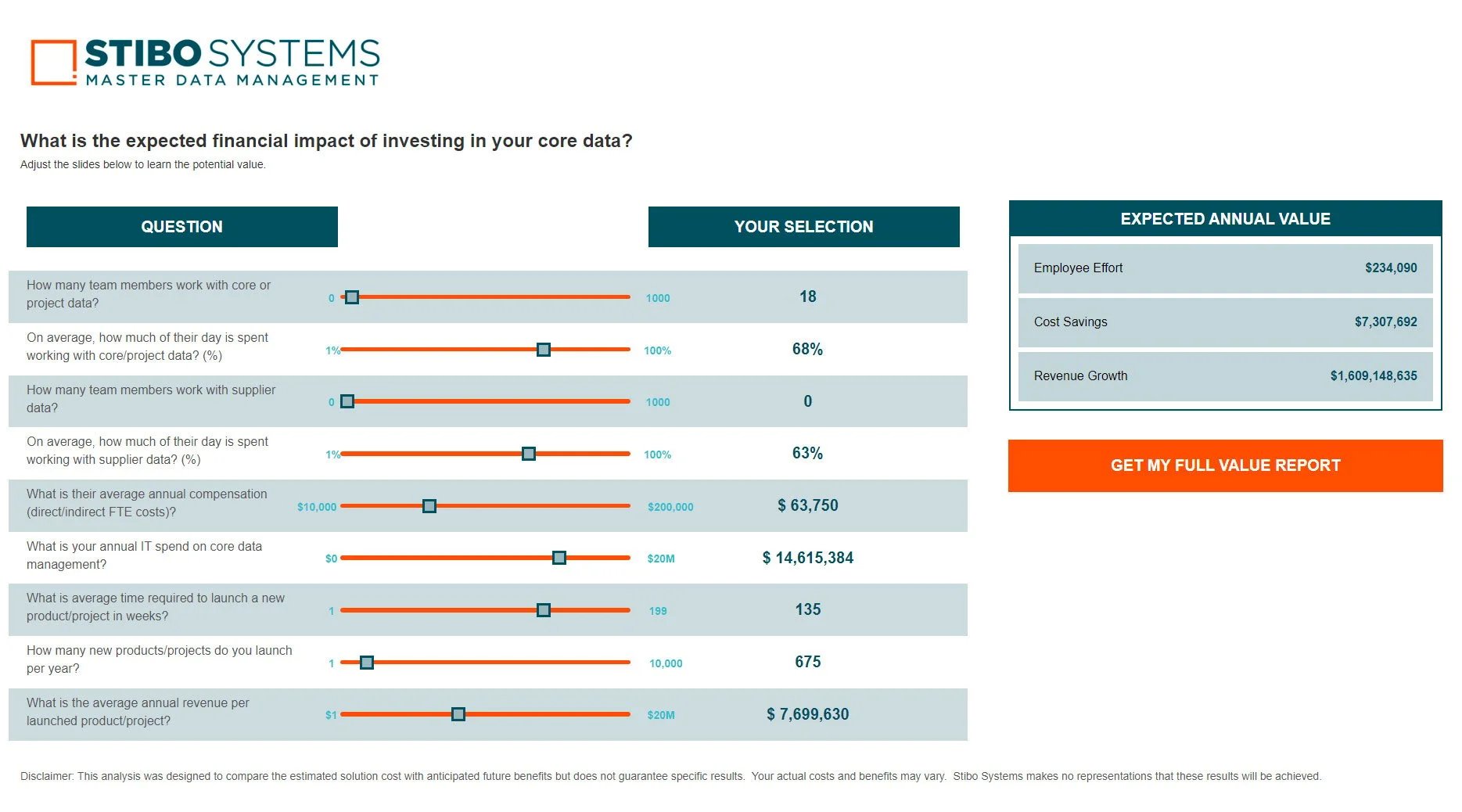

What are the major benefits of Stibo Systems master data management tool?

Stibo Systems master data management offers several key benefits, including:

-

Improved data quality: Stibo Systems' master data management tool allows organizations to standardize, validate and enrich their data, resulting in more accurate and consistent information.

-

Enhanced data governance: The platform provides robust data governance features such as role-based access control, data lineage tracking and data stewardship workflows, which enable organizations to better manage and control their data.

-

Increased efficiency: With Stibo Systems master data management, organizations can automate data-related processes and workflows, streamline data integration and reduce the need for manual data entry, resulting in significant time and cost savings.

-

Greater data visibility and insights: Stibo Systems provides a centralized view of all master data, which enables organizations to gain a deeper understanding of their data and make more informed business decisions.

-

Improved customer experience: With accurate and consistent customer data, organizations can provide a more personalized and seamless customer experience leading to increased customer loyalty and revenue.