Unified and enriched customer information can enhance your data analytics and provide actionable customer insight for corporate and investment banks

Relationship managers need insightful customer information upon which they can take action. Sometimes a single piece of unique information can give relationship managers in corporate and investment banks the edge they need to decide how to move an opportunity forward, or indeed avoid being exposed to risk. The availability and trustworthiness of that piece of information relies on the quality and richness of the data that is being analysed.

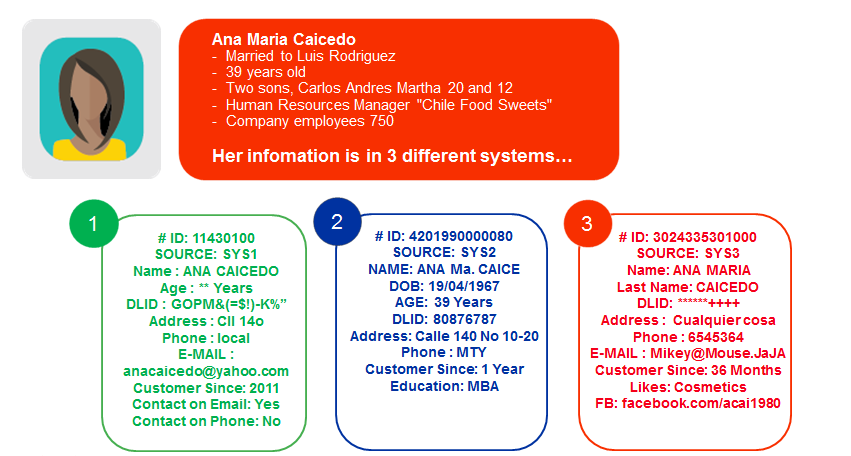

However, customers, products, assets, contracts and their associated transactions are often managed in business and technical silos. Relationship managers may be faced with the challenge of having corporate customers who wish to use multiple bank products over various locations.

Deciding a next best course of action, may require the relationship manager to manually reconcile inconsistent customer information from across these silos. Certainly, a source of wasted time and energy. And a source of risk. This is also frustrating for customers who seek clarity but are faced with different supporting procedures, processes, organisations and people.

Bank customer data that is reliable, available and insightful gives relationship managers their time back, enables them to take better informed decisions and, importantly, helps to uncover potential opportunities.

Make your banking business data-driven with trusted analytics

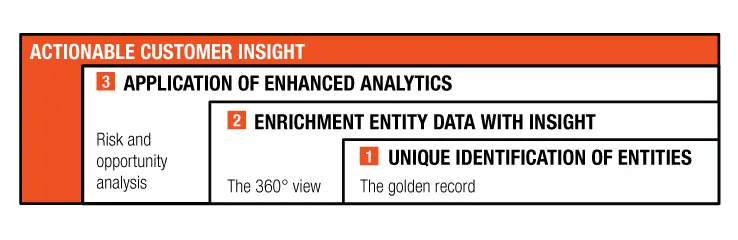

Cultivating this data-driven decision-making capability relies on delivering 3 key capabilities.

-

Identify your customers

The unique identification of entities at a corporate level is the foundational first step. It allows you to answer the basic questions of “who are our customers?” and “what legal form do they have?”. -

Enrich your customer data

Having established a unique identifier, you can start to join previously disparate and unrelated entity information to one related customer record. This enrichment phase can use both data sources from inside the organisation and externally. Commonly referred to as a 360-degree customer view or holistic customer master data record, the customer information will show extended relationships, including those that are contractual, party-to-party and line-of-business dependant. -

Apply data analytics

The application of analytics reveals insight. The master data can be used to navigate bigger data sources, such as data lakes, to help in determining deeper data relationships between entities that will intimately yield insightful information. And possibly new opportunities.

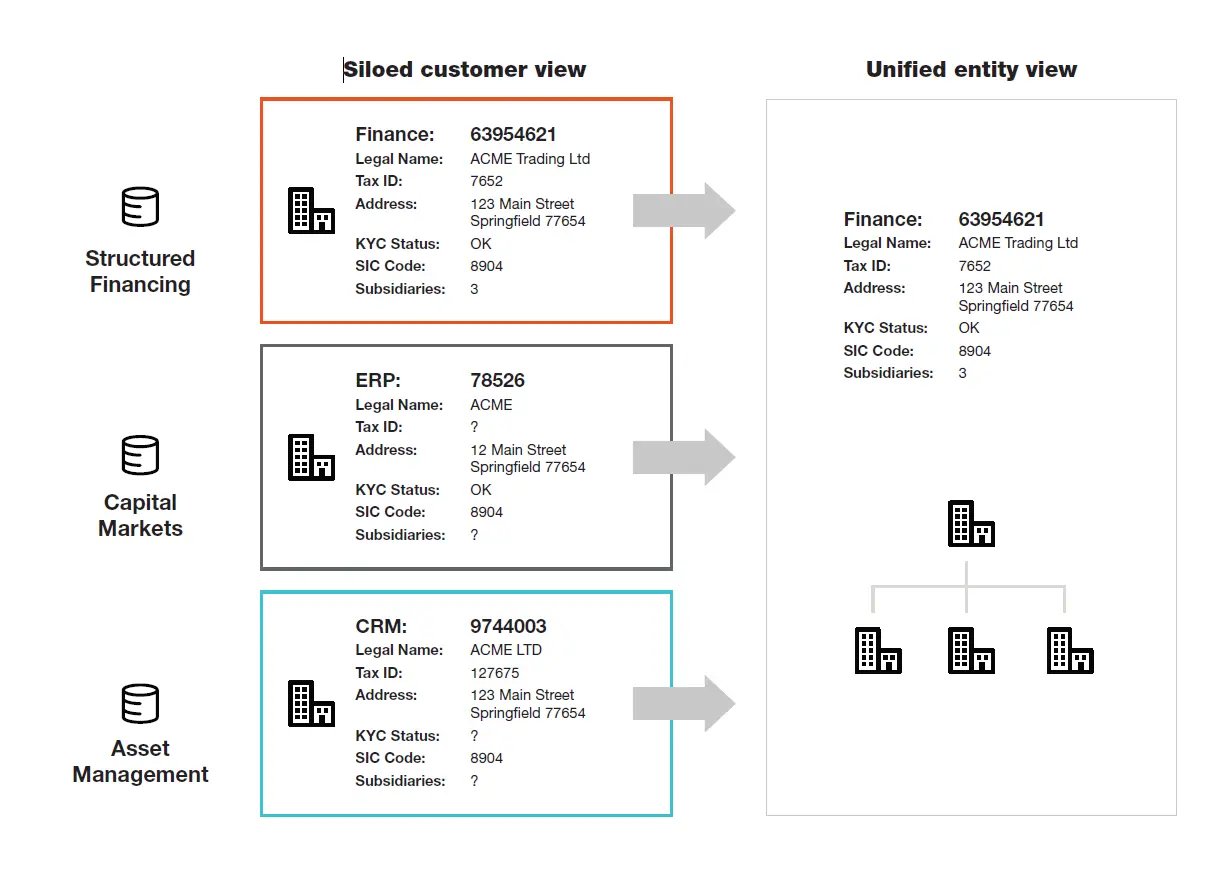

Corporate and investment banks can use master data management to reconcile their customer data

To achieve enhanced analytics, you need to first reconcile your customer data from a siloed to a unified entity view. As an example, corporate customers with subsidiaries across borders can have different engagements with their bank in different countries. However, the bank’s relationship manager in one country needs insight into the customer’s engagements with the bank in other countries to be able to identify business opportunities – and risks.

Establishing a unified entity view is a crucial prerequisite to achieve this kind of deep customer insight.

Master data management is a key enabler for providing a single, trusted view of business-critical information for analytics purposes. A key advantage of master data management is that existing data sources and silos can remain in place while the master data management solution does the hard work of transforming this data into high-quality, ready-to-use information.

Master data management automates the processes that ensure entity data is unique, coherent and relevant for analytical requirements. Certainly, you may want it to do this quietly in the background, but key to the success of master data management implementations is the ability to define and monitor (with KPIs) the business rules that transform the data. Crucially, this allows the business to take ownership of data KPIs and implement continuous improvement plans for data.

As analytics capabilities move more and more towards real-time and machine learning, more and more onus will be placed on data owners to ensure that their data sources will be measured and monitored as being fit for purpose.

This master data management-enabled data fitness is the foundation of data-driven decision making and the ability to discover new business opportunities.

To find out more about entity insight and the data you need to achieve it, download the white paper below.